You can think of a 1099-B as something similar to a credit card statement — but for your investment activity.

Updated Jul 19, 2024 · 2 min read Written by Sabrina Parys Assistant Assigning Editor Sabrina Parys

Assistant Assigning Editor | Taxes, Investing

Sabrina Parys is an assistant assigning editor on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her previous experience includes five years as a copy editor and associate editor in academic and educational publishing. She is based in Brooklyn, New York.

Assigning Editor Pamela de la Fuente

Assigning Editor | Consumer Credit, Taxes, Retirement, Underrepresented communities, Debt

Pamela de la Fuente leads NerdWallet's consumer credit and debt team. Previously, she led taxes and retirement coverage at NerdWallet. She has been a writer and editor for more than 20 years.

Pamela joined NerdWallet after working at companies including Hallmark Cards, Sprint Corp. and The Kansas City Star.

She is a thought leader in content diversity, equity, inclusion and belonging, and finds ways to make every piece of content conversational and accessible to all.

She is a graduate of the Maynard Institute's Maynard 200 program, and was a presenter at the National Association of Black Journalists convention in 2023. She is a two-time winner of the Kansas City Association of Black Journalists' President's Award. She is also a founding co-chair of NerdWallet's Nerds of Color employee resource group.

Pamela is a firm believer in financial education and closing the generational wealth gap . She got into journalism to tell the kind of stories that change the world, in big and small ways. In her work at NerdWallet, she aims to do just that.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

MORE LIKE THIS Tax forms Tax preparation and filing TaxesTable of Contents

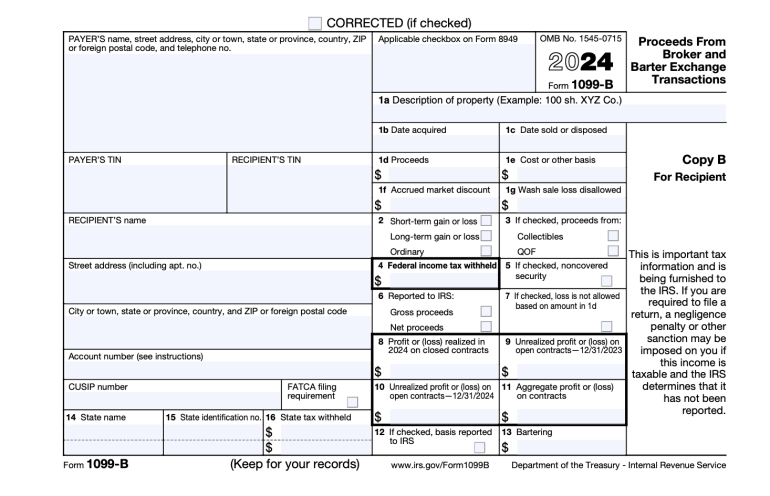

MORE LIKE THIS Tax forms Tax preparation and filing TaxesA 1099-B is an informational document brokers send to people who have sold securities, such as stocks or bonds, through a brokerage during the year. It outlines which securities were sold and categorizes them based on tax type to help investors make sense of their capital gains or losses .

Tax filers need to reference their 1099-B forms when filling out their tax returns and other forms investors typically need to deal with at tax time, such as Schedule D and Form 8949.

A 1099-B reports on transactions made in non-retirement brokerage accounts. It doesn’t report on or include information about any investments held in a 401(k), an IRA or other retirement savings vehicles.

If you sold any of the following throughout the tax year through a broker or brokerage, you can expect a 1099-B in your inbox or in the mail:

Bonds and other debt instruments. Short sales. Commodities. Regulated futures contracts. Foreign currency contracts. Forward contracts. Securities futures contracts for cash [0]Other instances that could result in a 1099-B landing on your doorstep:

You participated in bartering or a barter exchange network, where you traded your services or products for value instead of cash. A simplified example is exchanging your services as a freelance photographer in return for construction services completed on your home. The IRS considers the value of the trade as earned income that is reportable and taxable [0]

Internal Revenue Service . Publication 525: Taxable and Nontaxable Income. Accessed Sep 14, 2023.You received cash, stock or another type of property from a corporation that your broker knows or “has reason to know [0]

Internal Revenue Service . Instructions for Form 1099-B. Accessed Sep 14, 2023. .” This can be a little complicated, but the instructions for Form 1099-B have more details.Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees.Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax. File up to 2x faster than traditional options.* Get your refund, and get on with your life.*guaranteed by Column Tax

A 1099-B lists your investment sales activity and what type of transactions they were tax-wise. It also typically notes:

When you acquired a security and how much you paid for it. When you sold the security and for how much. Whether the brokerage withheld any state or federal taxes on your behalf.

All of this information is intended to help you determine your net capital gain (profit) or loss from your transactions, which will help you figure out how your investments will be taxed.

Generally, here's how that works:

Capital gains: When you sell a security for more than you originally paid for it, you may have to pay either long-term or short-term capital gains tax on your profit. Which tax rate applies to your sale depends on how long you held the asset before deciding to sell.

Capital losses: If you sell something for less than it was worth when you purchased it, that’s called a capital loss. Because the IRS taxes you on your net capital gains (your total gains minus your total losses), capital losses can potentially help to reduce your capital gains and even ordinary income.

Keep in mind that even though your investment gains are taxable income, many things, such as tax credits and deductions , can offset or influence your final tax bill.

If you do a lot of business with a brokerage, you may receive what’s called a composite substitute 1099 [0]

. When this happens, your brokerage has rolled a bunch of different 1099s into one document rather than sending them out individually. Depending on what income you generate through the brokerage, you may see information about your dividends ( 1099-DIV ), interest ( 1099-INT ), stock sales (1099-B), or even miscellaneous payments ( 1099-MISC ) on a single form.

There are many types of 1099 forms . The easiest way to tell them apart is to look at the abbreviations that follow the “1099” — they are typically shorthand for the type of taxable income. A 1099-INT, for example, summarizes any taxable interest you earned throughout the year from a source like a high-yield savings account. A 1099-DIV summarizes your taxable dividend income.

Brokers are required to send a 1099-B and composite 1099s by February 15 [0]

. Depending on the type of investing you do, some 1099-Bs could also need to be corrected by the broker after February 15, so keep that in mind when filing your return.

If you file with incomplete or incorrect information, you may need to file an amended return later. You can also opt to request a tax extension using Form 4868 if you think you’ll need more time to get the correct information, but keep in mind your tax payment is still due on the regular filing deadline in mid-April.

» Need to call in a professional? How to find a CPA near you

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Learn More About the authorYou’re following Sabrina Parys

Visit your My NerdWallet Settings page to see all the writers you're following.

Sabrina Parys is a content management specialist on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her work has appeared in The Associated Press, The Washington Post and Yahoo Finance. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105