If you’re a nonresident alien in the US, you may be wondering if there are any tax reliefs available which can help you save money on your tax bill.

While the answer to this question is likely “yes”, exactly what you will be entitled to will depend on your personal circumstances.

The best place to start is by checking whether or not you are entitled to any tax treaty benefits.

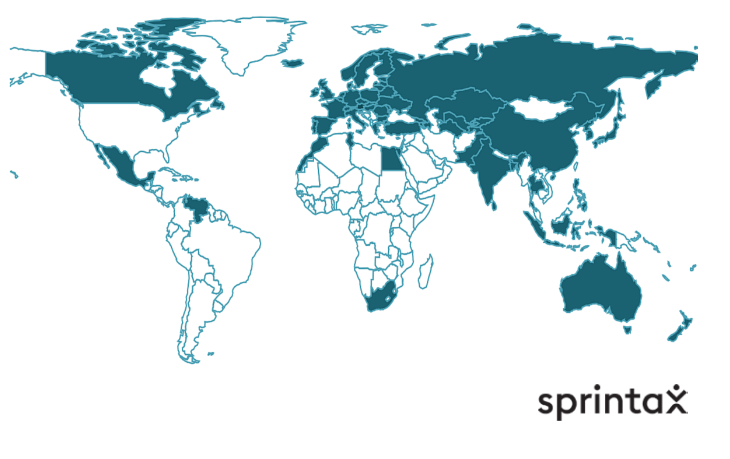

The US has signed tax treaty agreements with 67 countries around the world and if you are entitled to benefit from one of these agreements, you could potentially save a lot on your taxes.

In this guide, we are going to take a closer look at tax treaty benefits – what they are and exactly how you can claim them.

US tax treaties (also known as double taxation agreements (DTA) are specific agreements between the USA and foreign countries that outline how nonresidents will be taxed in each country.

Generally, under these tax treaties, residents of foreign countries (including foreign students and scholars) are taxed at a reduced tax rate and can benefit from exemptions on many different types and items of income.

That is a great opportunity to save some money so it is really important to ensure that you claim the treaty benefits you are eligible for.

IRS Publication 901 (or the tax treaty document itself) will tell you whether a US tax treaty with a particular country offers a reduced rate of income tax for nonresidents.

Currently, the US tax treaty network covers approximately 65 countries all over the world, including:

Whether or not you are eligible to avail of tax treaty relief will depend on four factors:

Determine your tax treaty eligibility easily online with Sprintax. Learn more.

The exact type of tax relief you can claim from a double taxation agreement will depend on the treaty that the US has signed with your home country.

Below we will take a look at some examples of tax treaty benefits which can be claimed in the US.

Below we have highlighted some of the most important articles from the tax treaty that Indian nationals should be aware of.

If you are an international student from India and you are in the US on a student visa (for example, an F-1 or J-1 visa) it is likely that you will not have to pay tax on any grants, scholarships or remuneration from employment – any payment you receive for your maintenance, education or training.

Article 21 also enables Indian students and trainees to avail of the standard deduction ( $13,850 – for the 2023 tax year) . The standard deduction can change from year-to-year) on their income tax return.

Indian nationals who travel to the US for the purpose of teaching or engaging in research at a university or college will also be ‘tax exempt’ on income earned from these activities for two years from their arrival to the US on this status.

Note: this tax treaty is retroactive. If the teacher or researcher stay more than 24 months in the US, they can potentially lose all benefits and may need to pay tax on income which was considered exempt under the tax treaty in previous years.

Advik Patel arrived in the US from India for the first time on an F-1 visa in 2020. In 2023 he started an OPT (Optional Practical Training) position. As per the requirements of his visa, he is granted permission to work and he has already received his SSN.

1. Residency

Advik is considered a nonresident for tax purposes, as he is still in his 4th year on F-1 Visa status.

2. Income Type

Advik is working as a researcher as part of his OPT. Wages paid to him are considered compensation during studying and training.

3. Tax Forms

Advik does not need to provide an 8233 for the income, which is exempt under the Indian tax treaty.

However, he will need to complete a W-4 in the same manner as that of a resident for tax purposes with the same exemptions and allowances.

Indian students or apprentices are allowed to use the standard deduction as well as child and other dependent tax credits where applicable (provided they meet certain requirements)

At the end of the year Advik should receive form W-2, but the standard deduction allowance is applied in the calculation of the income tax – just as it would be for a tax resident as it is a condition of the Indian tax treaty. As a nonresident, he is exempt from paying FICA and FUTA taxes.

4. Tax treaty determination

Advik can use the standard deduction of $13,850 and resident tax credits where applicable on his 2023 tax return.

The US – China tax treaty deals with the double taxation of numerous types of income, including wages, dividends and capital gains.

The treaty ensures that no one will have tax withheld at a higher rate than the higher of the two countries’ tax rates, and it also defines where taxes should be paid, which normally depends on where the income arises.

Chinese citizens who are in the US for the primary purpose of teaching, giving lectures or conducting research at a university, college, school or other accredited educational institution or scientific are exempt from tax in the US for a period of three years in aggregate.

A Chinese student, business apprentice or trainee is exempt from tax (for such period of time as is reasonably necessary to complete the education or training) in the US on:

Zhang Wei arrived from China on an F-1 student visa for the first time in 2019 and started his OPT in 2023. As per the requirements of his visa, he is granted permission to work and he already received his SSN.

1. Residency

Zhang is considered a nonresident for tax purposes, as he is still in his 4th year on F-1 Visa status.

2. Income Type

Zhang is working as a researcher as part of his OPT. Wages paid to him are considered compensation during studying and training (income code 20).

3. Tax Forms

Zhang must provide Form 8233 for the income which is exempt under the Chinese tax treaty and a W-4 (labelled NRA) for any income paid on top of the first $5,000 which are covered by the tax treaty.

Income covered by the tax treaty is taxed at 0% and all other income is taxed at the graduate rate for federal tax purposes.

At the end of the year, Zhang should receive two income tax documents – 1042-S with the income covered by a tax treaty and form W-2, if he has income about what is covered by the tax treaty. As a nonresident he is exempt from paying FICA and FUTA taxes.

4. Tax treaty determination

Zhang can earn up to the first $5,000 in compensation tax free for studying and training. The tax treaty benefit applies only such period of time as is reasonably necessary to complete the education or training. Zhang must also be compliant with the requirements of his visa.

Canadian citizens who are in the US as international students will be exempt from tax on any US income received for activity related to education, training or maintenance.

Note: any Canadian citizen (including students, trainees, teachers and researchers and all other visa holders – as long as they are non-residents) can be exempt for up to $10,000 in personal services (OPT, teaching and research are considered personal services) if their total income is under or equal to $10,000.

If their income exceeds $10,000, they must pay US taxes on the whole amount. The tax treaty article that covers this type of income is ARTICLE 15 – Dependent Personal Services.

German nationals that visit the US as a professor or teacher at an accredited university, college, school, or other educational institution, or a public research institution will not be subject to US tax on income earned from these activities (for not more than two years from the date of arrival).

Meanwhile, German students who are studying in the US can avail of tax treaty benefits on any income they receive related to their training, education or maintenance.

German students will also not be taxed on any grant, allowance or award from a non-profit religious, charitable, scientific, literary, or educational private organization or a comparable public institution they receive in the US.

German students will also not be taxed on any income from dependent personal services (includes wages, salaries, fees, bonuses, commissions, and similar designations for amounts paid to an employee) not in excess of $9,000 (for not more than 4 years from the date of their arrival in the US.

Where a resident of the Philippines is in the US to teach or engage in research (or both) at a university or other recognized educational institution, their income earned from these sources will be exempt from tax in their first two years (only if their visit is expected to last two years).

If a citizen of the Philippines is in the US to study, research or train at a university will not be subject to taxation (in their first 5 years from the date of arrival) on:

Korean citizens who are legally in the US for the purpose of teaching or engaging in research will be exempt from tax for income earned from these activities in their first two years, only if their visit is expected to last two years.

Korean international students who are in the US to study, train or research at university will be exempt from tax on any grant, allowance, award or income ($2,000 or less) from personal services performed.

French citizens who are in the US to study, secure training or research will not be subject to US tax on any income earned from:

* In each tax treaty where ‘research’ is mentioned, the research must be non-profit and in public interest.

When you start working in the US, your employer will ask you to fill out some important payroll forms (such as forms W8-BEN and 8233).

These forms help to ensure that tax treaty benefits are applied to your income and that the correct amount of tax is withheld.

These forms can be tricky to complete, and it’s important to take your time as it is very important that they are completed correctly.

In order to claim a tax treaty benefit on non-compensatory scholarship or grant, you must fill out a W-8BEN form.

To fill out your Form W-8BEN, you will need to know your:

If you are an international student and wish to claim a tax treaty benefit on income from personal services, compensatory scholarship or grant receiving, you will need to complete a Form 8233 and submit it to your university.

Note: You must complete a separate Form 8233:

To fill out your Form 8233, you will need the following details:

Details of your US visa type including:

Yes, if you pay too much tax during the year or you did not provide W-8Ben or 8233 form on time, you will be entitled to a tax refund.

You can claim your overpaid tax back when you file your end of tax year 1040NR tax return.

If you find US tax to be daunting, the good news is that help is on hand!

Sprintax is the only online software for US nonresident taxes.

We can help you to file your federal and state taxes – ensuring that you are fully compliant with the IRS and that you claim every tax relief you are due (including tax treaty benefits).

When you choose Sprintax Returns (formerly Sprintax tax preparation), you can enjoy a stress-free service from start to finish. Plus, if you have any questions, our live chat team are on hand 24/7 to support you.

What’s more, if you are starting a new job (or OPT/CPT position), and you expect to receive scholarship, grant or any other type of income during your study or research, we can also help you to complete the pre-employment forms you need. This will ensure you never pay more tax on your income than you need to.